Home Insurance Claims

Whether your home has been damaged by fire, theft or another disaster, we're here to help. Our mission is to provide an easy and tailored claims experience by leveraging innovative technology and trusted partners to assess damage and estimate repairs.

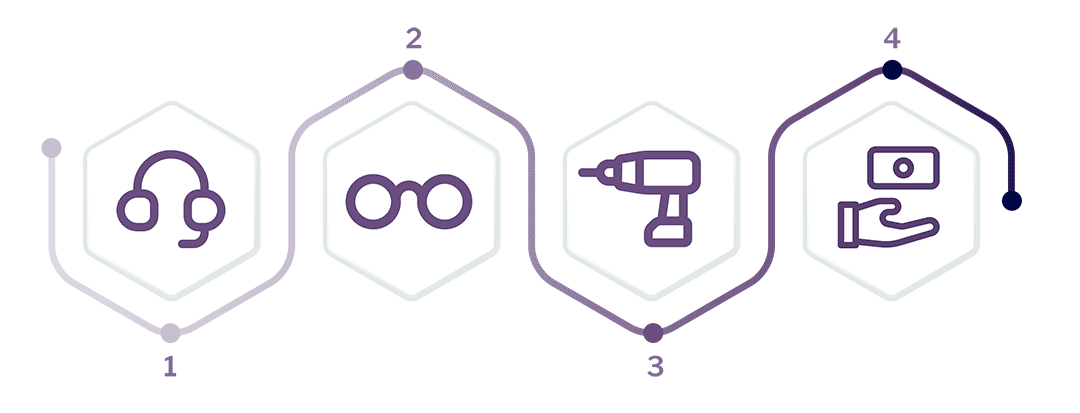

Openly's Claims Process

1. Report a new claim

Direct your client to file a claim quickly and easily using Openly's online Claims Portal. You may also submit a claim on your client's behalf online or by calling 888.808.4842.

2. Assessment

Our claims team will review the claim and assess the damage. The assigned adjuster will contact you and your client to provide detailed information and outline next steps.

3. Estimate & repair

Based on coverage and location, your client can choose from our network of trusted partners who will inspect, estimate, and complete the necessary repairs.

4. Payment & support

Even after a payment is made, our commitment to your client doesn’t end there. We will continue to be your client’s advocate, offering ongoing support throughout the process.

Claims FAQs

A number of factors should be considered when deciding to file a claim.

- Will the damage or cost of repairs exceed the deductible amount?

- Is the home unsafe to live in because of the damage caused by the loss?

- Was anyone injured on the property?

If you have any questions about your policy or filing a claim, please contact your agent or our claims professionals at 888-808-4842.

The deductible is the amount you are responsible for when a loss occurs and is subtracted from the total settlement amount. Unlike some insurance policies that have annual deductibles, homeowners insurance deductibles are per occurrence.

- Protect yourself and your loved ones and call authorities, if needed

- Prevent further damages which may include:

- Stopping the source of the water

- Secure your home by conducting temporary repairs (cover broken windows, doors, exposed areas of roof, etc.)

- If needed, contact a professional to help you protect your home from any additional damages. We have trusted partners, if you need help selecting one.

- To file a new claim:

- Submit a claim online

- Contact your agent

- Call us at 888-808-4842

- Take photos and videos to document the loss

- Keep all receipts

Your policy covers Additional Living Expenses (ALE). This means you continue to pay your regular expenses such as your mortgage, and Openly pays/reimburses you for the additional costs you incur as a result of a covered loss.

Our knowledgeable claims adjusters will be your advocate throughout the entire experience. Openly adjusters utilize their knowledge, state of the art technology and trusted network of partners to ensure a tailored, straight-forward claims experience.

We’ve partnered with some of the top contractor networks in the industry to ensure that you have the best options to move forward with your repairs. These partners include mitigation experts to assist after a water loss and general contractors who can be your expert in rebuilding damages.

Two of the main benefits of choosing to use a trusted partner include:

- Guaranteed reputable, local, licensed professionals guiding you through the repair process

- Warranty on all completed work

Have a claim?

You can file a new claim online or contact your agent for assistance with the filing process.

For questions on existing claims, we can be reached at 888-808-4842 during our claims business hours:

Monday-Friday, 8am-8pm ET

Saturday, 9am-4pm ET